Hungover from celebrating a personal milestone at publishing Tech Company Brief Issue #10, the HackerNoon team was back to work as the launch of #Noonies 2022 neared.

Unfortunately, there isn't a category for most Tech Briefs written, else I (the author of this brief) would have won it hands down; but we do have cash rewards and NFT prizes to give away across multiple categories including Emerging Tech and Gaming and you can head on down to Noonies.Tech to participate! 🏆

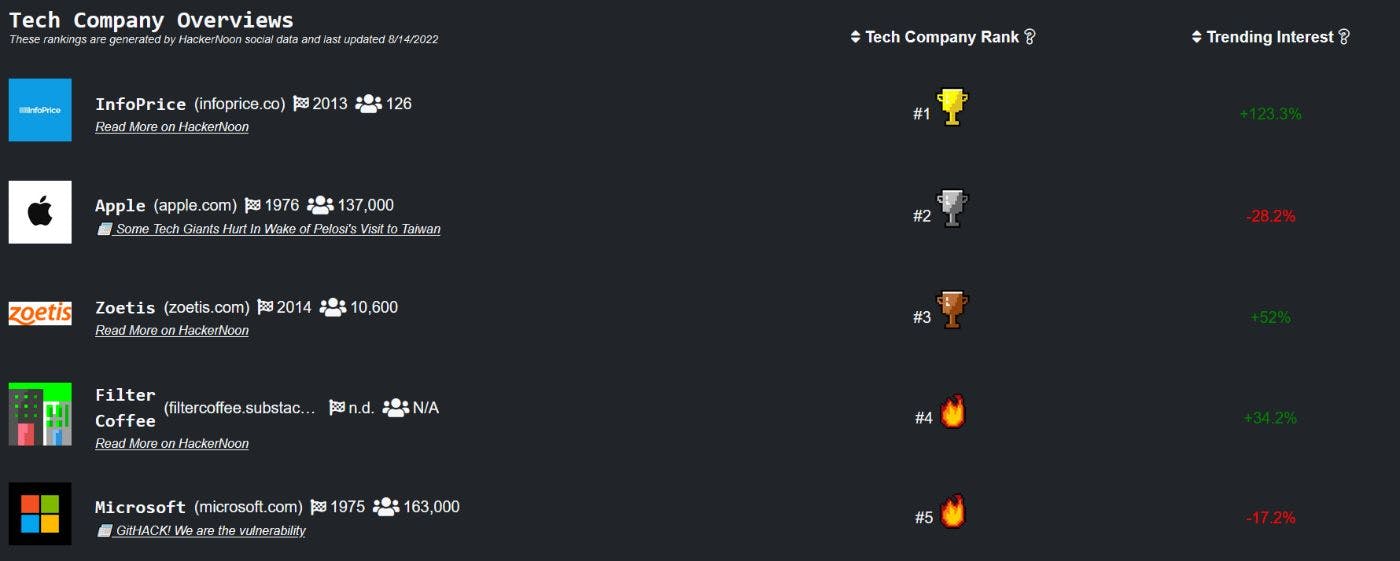

This week's tech rankings are a bit unusual in that we have new entrants making it to the top 5 (including the coveted #1), finally disrupting the monopoly (or technically the oligopoly) of tech giants playing musical chairs amongst themselves. But of the tech giants HackerNoon's team closely follows, Apple 🍎 landed on the #2 spot.

Not happy with the better-than-expected profits in its most recent quarter, the Silicon Valley firm is planning to expand the number of ads you see on your iPhone and iPad in an attempt to make big bucks™. Apple already advertises on its first-party apps, but the expansion could mean finding ads in apps such as Apple Maps. This, friends, is the future and I hate it.

Meanwhile, Microsoft 🖥️ — which ranked at #5 this week — has been taking shots at Sony (and by extension, the PlayStation), for failing to play catch up with its mega-popular and highly successful video game subscription service Gamepass 🕹️. For its part, Sony relaunched the PS Plus as a true games-on-demand service to compete with the Gamepass, but the latest offering has failed to catch on as well as the Gamepass did. So Microsoft thought it would be great to school the Japanese tech giant on why that might be: in documents filed with Brazilian competition authorities, the Redmond firm suggested that Sony could do better if it launched its first-party games on the PS Plus day one, instead of, ya know, timing them so they join the service once everyone and their grandmas has already played it. What a burn.

Last week, we highlighted a deal by Amazon 📦 to get even more of your data. Looks like the company, which was in the #11 spot isn't stopping anytime soon, and is now expanding its so-called palm-scanning payment tech to more Whole Foods locations. Palm-scanning works exactly as you'd expect it to: you scan your palm to make payments. Understandably, not everyone is thrilled about the technology.

Elsewhere, Elon Musk sold more of his shares in Tesla 🚗 — which was listed one rank below Amazon at #12 — to finance a potential Twitter deal. ICYMI: Musk is desperately trying to walk away from the acquisition, but Twitter's having none of it. The latest sale share gives Musk access to a cool $6.9 billion in the event that Twitter forces the deal to close. Feel free to let us know if you think the deal will come through. 👾

In the meantime, thanks for reading Tech Company Brief Issue #11! If you'd like to see which tech companies are rising and falling in the public consciousness, feel free to head down here. See y'all next week.

PEACE! ☮️