Say what you will of Nvidia, but the Santa Clara, Calif.-based chip maker has won the AI lottery.

Jensen Huang's company is quite literally the only business selling the metaphorical shovels during the ongoing AI gold rush, and as you can imagine, it has made the company very, very rich. Nothing drove that point harder than Team Green's second-quarter earnings results, released last week and

During the second quarter of the year, Nvidia

Underpinning the results was the fact that the company's second-quarter net income was more than what it had made throughout the entirety of its last fiscal year. Yes, Nvidia made more profit in a single quarter than it had in an entire year. How's that for a jackpot?

Understandably, Wall Street was stunned. While AI might still be some ways off from dominating the world, it was already filling up the coffers of the company providing the hardware to make that a reality.

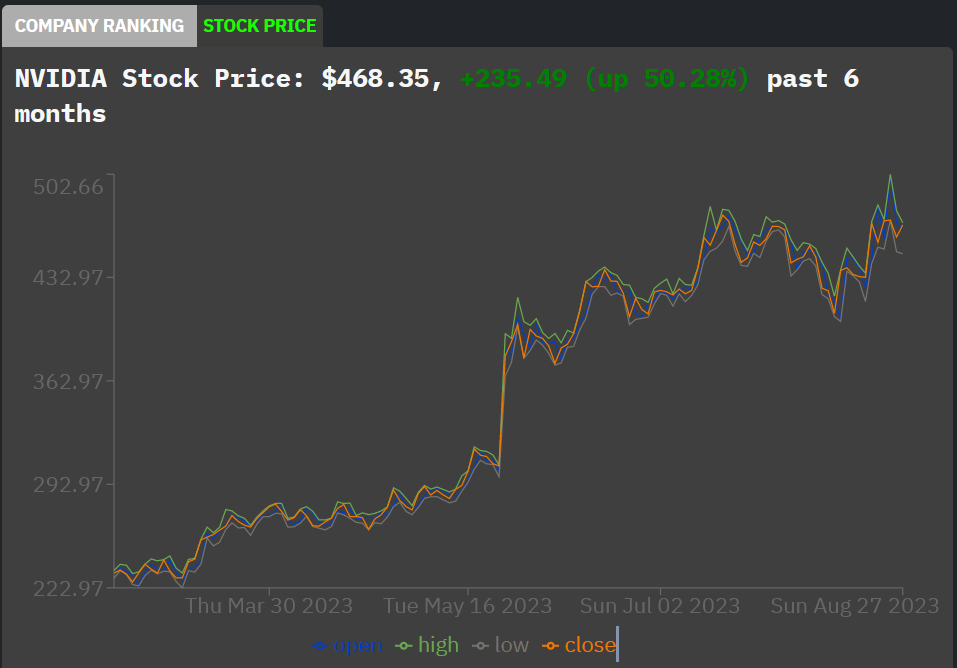

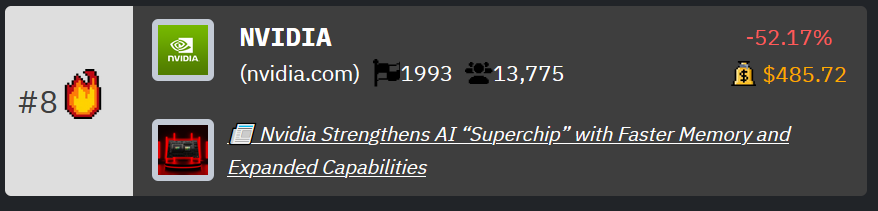

In fact, so successful has the company been, that its stock price has more than doubled just this year alone:

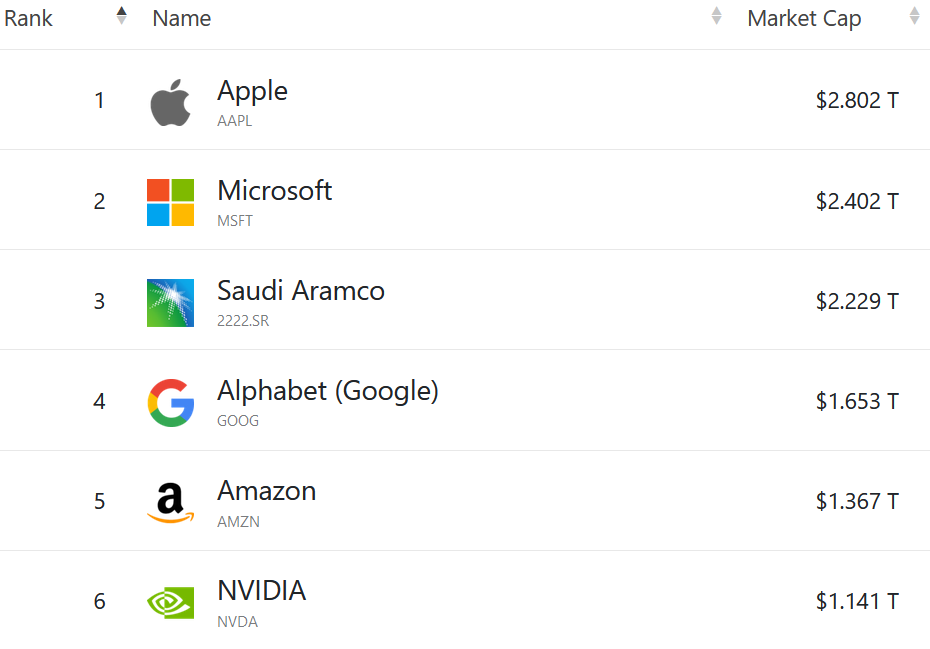

And with such a meteoric rise in its stock price, Nvidia has comfortably

For context, Nvidia's two direct competitors —

And what's worse, Nvidia isn't even happy with its valuation. A report from Reuters said the company's $25 billion share buyback, announced alongside its earnings, left many market participants

Now, share buybacks are one of the ways a company rewards its shareholders besides dividends, but they're usually undertaken when a company's stock price is cheap. But, as Reuters notes, "Nvidia’s shares have shot up some 220% in 2023, leaving investors searching for the reasons behind the company’s move."

"The message seems to be that (Nvidia's) management believes that their stock is undervalued," said Daniel Morgan, senior portfolio manager at Synovus Trust, which owns Nvidia shares.

Nvidia may have a reason for believing it's worth more than what it's currently valued at, given that it already expects to make more revenue during the third quarter of the year than it did during the second quarter — all driven by its A100 and H100 graphic cards that have become a key component in building and running AI applications like OpenAI's ChatGPT and other services.

👋 You’re reading part 1 of HackerNoon's Tech Company News Brief, a weekly collection of tech goodness that combines HackerNoon's proprietary data with internet trends to determine which companies are rising and falling in the public consciousness. Part 2 goes live tomorrow. Hate waiting? No problemo! Just subscribe here to receive the complete newsletter a day early in your inbox.

In Other News.. 📰

- Google’s AI-powered note-taking app is the messy beginning of something great — via

The Verge . - Intel says new 'Sierra Forest' chip to more than double power efficiency — via

Reuters . - OpenAI Passes $1 Billion Revenue Pace as Big Companies Boost AI Spending — via

The Information . - Meta avatars are finally getting legs (in beta) — via

TechCrunch . - AI tools make things up a lot, and that’s a huge problem — via

CNN . - Grayscale's big court win boosts Bitcoin and crypto sentiment — via

Axios . - Tesla ordered by auto regulators to provide data on ‘Elon mode’ Autopilot configuration — via

CNBC .

And that's a wrap! Don't forget to share this newsletter with your family and friends! See y'all next week. PEACE! ☮️

— Sheharyar Khan, Editor, Business Tech @ HackerNoon

All rankings are current as of Monday and may change by the time of publication. To view the latest ranking, visit HackerNoon’s Tech Company News Pages.