Have you been fantasizing about winning the third-largest lottery prize in U.S. history? Alas, it doesn't look like any of us hold the winning ticket for the whopping ~$1.34 billion jackpot, but the person who did is yet to come forward to claim the prize. And given that Illinois is one of the states where lottery winners can choose not to reveal their names, we may never know who won ;-)

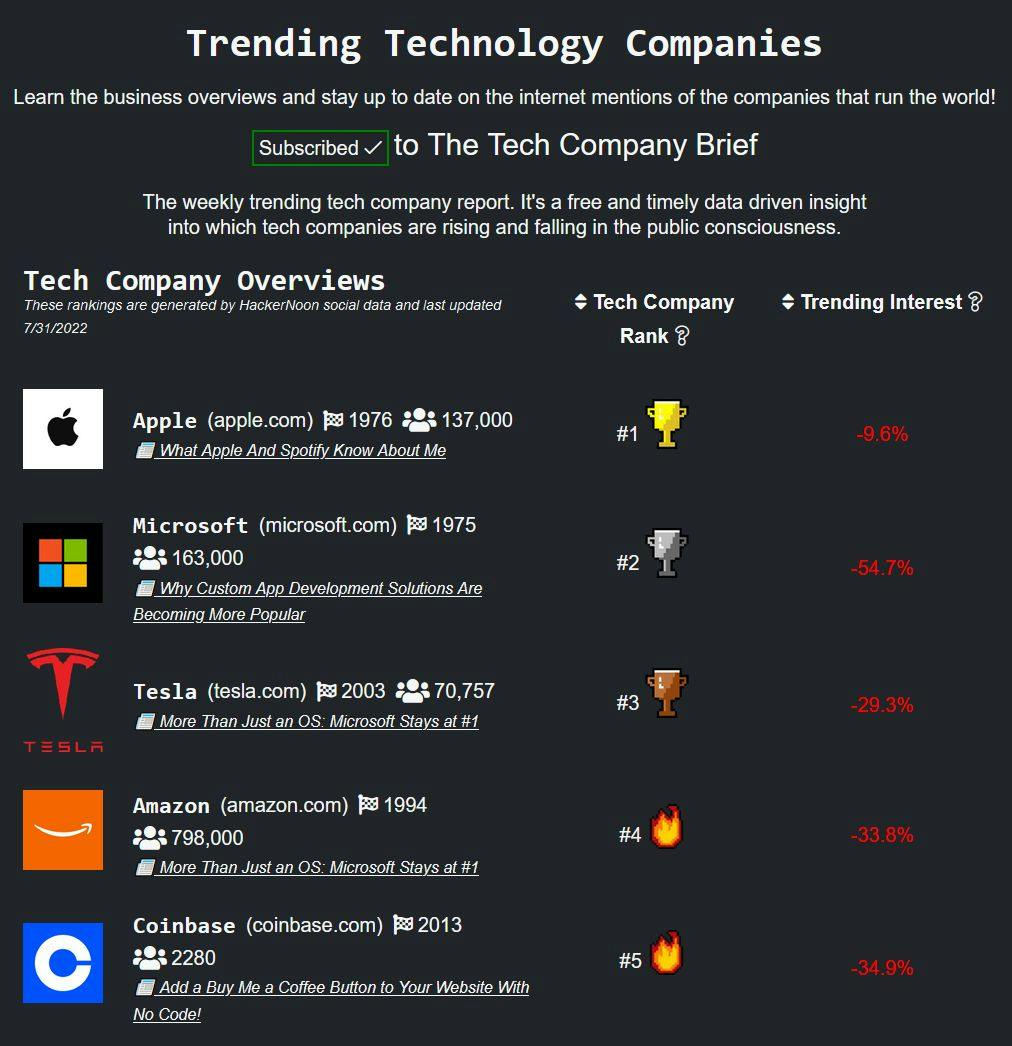

Nonetheless, the race to win the Mega Millions jackpot is over, which means we can move on with our lives and resume our regularly scheduled content: the weekly Tech Company Brief! Tech giantsMicrosoft, Apple, and Amazon were due to report earnings this past week, and the multitude of stories around the web about these results, and what they mean for where the economy is, likely played a key role in our latest round of HackerNoon Tech Company rankings.

#1. Apple 🏆

Apple dethroned Microsoft to secure the #1 spot this week. Inflation did not dent the iPhone maker's quarterly earnings as it reported better-than-expected sales and profit of $83.0 billion and $1.20 per share for the three months ended June 25, respectively.

Despite raking in billions, the company is following the lead of its tech industry peers in slowing down hiring and cutting costs as it grapples with a "challenging operating environment." Analysts believe the company is immune to broader economic hurdles though, given iPhone's loyal and relatively affluent customer base. And investors agree. Apple's share price went up after it reported its earnings, increasing its market cap from $2.529 trillion on Thursday to $2.612 trillion at end of Friday.

#2. Microsoft 🪟

Unlike Apple, Microsoft failed to beat Wall Street estimates. According to CNBC, the company's quarterly revenue experienced its slowest growth since 2020 after rising 12% year over year to land at $51.87 billion. Profit for the quarter ended June 30 stood at $2.23 per share, below CNBC expectations of $2.29.

But the slow growth barely knocked the wind out of the Richmond-based firm, which is already looking to do better in the future. The tech giant is forecasting that its annual revenues would grow by double digits, driven by demand for cloud computing services.

Microsoft also accused an Austrian spy firm this past week of creating malicious software to spy on a number of unidentified banks, law firms, and strategic consultancies. The firm, called DSIRF, responded to the accusation, noting that its software — called Subzero — was "developed exclusively for official use in states of the EU. It is neither offered, sold nor made available for commercial use." Not sure if that's better or worse.

#3. Tesla 🚘

Tesla had reported its earnings earlier than others on this week's list. The automobile maker generated $16.93 billion in revenues and $1.95 per share in profit for the three months ended June 30. The biggest news at the time the results were released wasn't the financials though: it was a surprise announcement that the carmaker had liquidated 75% of its Bitcoin holdings for $936 million during the second quarter of the year.

Of course, no news about Tesla is complete without a mention of its co-founder and CEO Elon Musk. The eccentric billionaire rubbished a report by The Wall Street Journal that claimed Musk had an affair with Google co-founder Sergey Brin's wife. Musk says he's still friends with Brin, though a report from Insider claims the billionaire asked his financial advisers to sell his investments in Musk's companies, so who knows 🤷♂️

#4. Amazon 📦

Even though Amazon didn't post a quarterly profit, its results still beat estimates. The eCommerce giant booked $121.23 billion in revenue, a cool $2 billion above expectations. Loss for the quarter ended June 30 amounted to 20 cents per share.

Like Apple, analysts believe Amazon too can weather the broader economic hurdles given that its focus goes beyond the retail industry. The company's shares were already trading higher this past Thursday despite the loss, indicating confidence in the tech giant's booming cloud business and ramp-up in service offerings.

One of those offerings may be an eerie ability by Amazon's Alexa to deepfake anyone's voice after being fed less than a minute of their recording. It's bad enough that the virtual assistant is always listening to you (though these guys think it's not that bad of a thing), but to be able to fake someone's voice? We'll let you decide if that's the kind of future you want to live in.

#5. Coinbase 🪙

Coinbase may have been the odd one out this week since it hasn't actually reported its earnings yet, though they're expected sometime next week.

The crypto exchange's bad luck just isn't giving up. Just this past week, Coinbase shares dropped after media outlets began reporting that the SEC was investigating whether the company was selling securities masquerading as digital assets, effectively bypassing the regulator's oversight. If that wasn't bad enough, a Coinbase manager was also charged recently for __insider trading__by the Justice Department. Ouch!

So that second-quarter earnings report better be the best f*cking thing ever, or investors could flip. But if the company's Q1 earnings are something to go by, it's probably going to be a miss.

And that's a wrap! Thank you for reading this week’s Tech Company Brief. If you'd like to follow these rankings in real-time, feel free to head down here. See y'all next week.

PEACE! ☮️