This is Part 1 of HackerNoon's round up of quarterly earnings. Part 2 will cover companies that are due to report their results this week.

Second-quarter

Better yet, the results

Now, even though Alphabet made more money AND beat expectations, investor response was.. muted. The company's stock rose briefly before falling back down. Why?

The

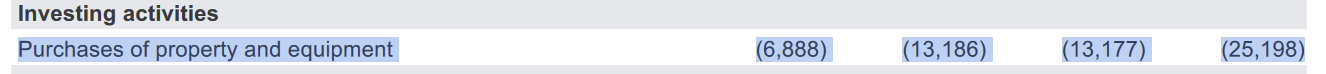

Alphabet's earnings release showed the company was doubling down on purchases of property and equipment, a line item that signals its investments in hardware to set up a formidable competitor to a host of generative AI products, including

Alphabet spent $13.19 billion on property and equipment purchases during Q2 and $25.2 billion during the first six months of 2024 — in both cases, nearly double year over year.

It's not all hardware though. The company's CFO also

Ruth Porat, the CFO, did not specify what she meant by content acquisition costs, but an educated guess would suggest the

In a nutshell, Alphabet, which is trying to play catch up in artificial intelligence, is continuing to buy hardware and striking licensing deals to make its product better and better.

Investors' question: how soon can they expect to make bank?

You see, now that the artificial intelligence fever dream is

OpenAI, for example, is reportedly on the

In Google's case, things are a little more dicey. The company's AI offerings have a habit of putting the company in

Any hiccups in Google's ability to present accurate and useful search results, especially if it now involves AI, is problematic for the company because Search is quite literally the company's bread and butter.

And with OpenAI now

Investors are rightly

AI isn't the only space Alphabet has faced setbacks. Wiz

Can nothing go right for the tech behemoth?

Google ranked #15 on HackerNoon's

In Other News.. 📰

- U.S. Strategic Bitcoin Reserve to Be Funded Partly by Revaluing Fed's Gold, Draft Bill Shows — via

CoinDesk - OpenAI endorses Senate bills that could shape America’s AI policy — via

TechCrunch - Google’s Olympics ad went viral for all the wrong reasons — via

CNN - Exclusive: New US rule on foreign chip equipment exports to China to exempt some allies — via

Reuters - This AI tool can plan your next vacation — via

Axios - CrowdStrike shares plunge 9.7% to lowest level of the year on report that Delta may seek damages — via

CNBC

And that's a wrap! Don't forget to share this newsletter with your family and friends! See y'all next week. PEACE! ☮️

**—

*All rankings are current as of Monday. To see how the rankings have changed, please visit HackerNoon's