Oh how the tables turn.

It was only last year that FTX's former CEO Sam Bankman-Fried ('SBF') was

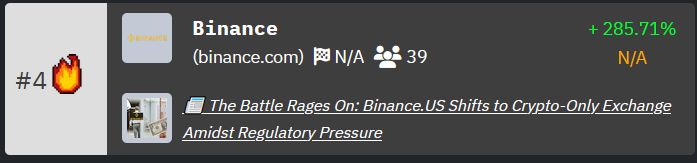

The ensuing drama and Twitter feud resulted in a winner-takes-all bloodbath that collapsed FTX and left Binance as the largest crypto exchange in the world and CZ with a reputation of someone you don't want to trifle with. Now, it seems, Binance is charged with the same crimes that caused FTX's downfall.

One of the reasons for FTX's troubles were revelations that the company was

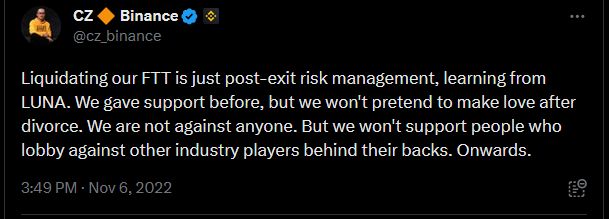

So when CZ decided that his company would exit its entire position in FTX's native token FTT over liquidity concerns, the public announcement caused a bank run and CZ's proclaiment became a self-fulfilling prophecy as FTX found itself unable to pay investors who were exiting their positions because it had been lending money to Alameda Research instead.

The whole thing has been documented to the moon and back, so we're not going to bore you with the details, but one thing that caught our eye was a change in CZ's approach to regulation. For a brief period, it seemed that CZ was going to bear the torch of regulation after SBF was no longer welcome by all the lawmakers he rubbed shoulders with.

Well, it seems CZ's wish has come true because The U.S. Securities & Exchange Commission has come knockin' on Binance's door and dragged world no. 2 Coinbase into the foray.

Last week, the U.S. regulator

A day later, it was Coinbase's turn. In its

Both exchanges have denied the allegations and plan to defend themselves in court, though that hasn't stopped investors from panicking, with Coinbase and Binance each seeing

Keeping the SEC allegations aside, at issue also seems to be whether cryptocurrency are securities. Binance and Coinbase argue that they are not and the SEC is overreaching with its jurisdiction in the crypto sphere, though experts believe the regulator, under the leadership of Gary Gensler, will continue to bring tokens

So while the big guys duke it out in court, most of the smaller exchanges are expected to

We'll keep you updated as things play out. For now,

👋 You’re reading part 1 of HackerNoon's Tech Company News Brief, a weekly collection of tech goodness that combines HackerNoon's proprietary data with internet trends to determine which companies are rising and falling in the public consciousness. Part 2 goes live tomorrow. Hate waiting? No problemo! Just subscribe here to receive the complete newsletter a day early in your inbox.

In Other News.. 📰

AMD is clawing back atNvidia , looking tolaunch its own AI "superchip" to compete against Team Green, which already dominates the AI computing market with 80% to 95% of market share.- The UK will

host the first major global summit on AI safety later this year. Intel wasunable to convince the German government to give it more subsidies for the currently in construction advanced semiconductor manufacturing facility near Magdeburg, Germany.- In an apparent FU to

Google ,Twitter is refusing to pay its Google Cloud bills as its contract comes up for renewal this month, Platformerreports . - Reddit's decision to charge exorbitant prices for

third-party apps via its API isnot sitting well with its userbase.

And that's a wrap! Don't forget to share this newsletter with your family and friends!

See y'all next week. PEACE! ☮️

— Sheharyar Khan, Editor, Business Tech @ HackerNoon