Wall Street is a weird bunch. You'd imagine that a company that has consistently defied investors' expectations would be better received after it posts another quarter of record sales, but nope, that's not what happened.

On Wednesday, Nvidia released its highly anticipated quarterly earnings and they were, once again, as you'd expect them. Sales almost

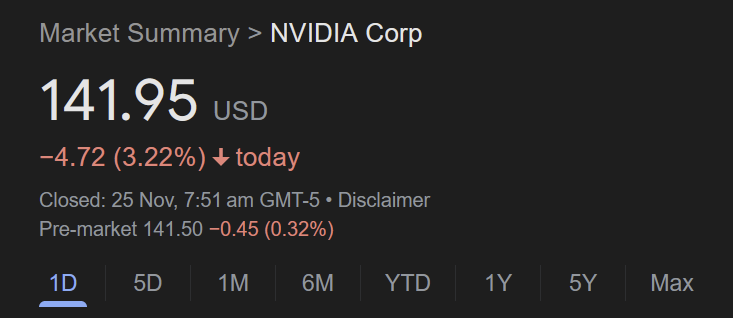

Yet, the company's shares fell.

It seems that it's simply not enough for Wall Street that a company is profitable, they want to know whether Nvidia, which is the most valuable company in the world, will continue to grow its profits.

Unfortunately for investors, Nvidia has signalled that its growth may not be as impressive as before.

When announcing its earnings, the company said that it expects to generate $37.5 billion in sales in the next quarter —

It's this slowing of growth which has Wall Street worried, so of course, the company's shares took a hit as soon as the earnings released and continue to trend downwards at the time of writing:

Now before you go and start terming investors a greedy bunch, there might be more at play here, and it all has to do with the company's Blackwell chips.

See, Nvidia's current bread and butter are the Hopper class of chips that have been a huge hit with corporations looking to build data centers to power their generative AI models. They are quite literally THE processors that everyone has been vying for, but they are due to be replaced by the Blackwell chips that are supposedly much, much better than Hopper.

HackerNoon is a community-driven publication home to a global network of 45,000+ published devs, builders, founders, makers, VCs, hodlrs, and hackers. Start submitting your tech stories and tutorials to get published FREE on HackerNoon — no pop-ups, no paywalls.

Problem though is that Nvidia announced the Blackwell chips all the way in March but is yet to deliver them in a large enough scale to its customers, like Amazon, Microsoft, and Google. In fact, the company was due to begin large-scale shipping of the Blackwell chips by the end of the year but has hit some snags both

Publicly, Nvidia continues to

Which means Nvidia may have inadvertently given credence to the reports by implying that sales in its next quarter may slow. If I had to hazard a guess, the company thinks it won't be able to deliver the Blackwell chips in time for them to make a big difference to its bottom line, at least, not in the immediate future.

And that's what both Wall Street and investors may have caught on, resulting in a bearish view on the stock.

Once the Blackwell chips do start getting shipped though, that might be a whole different story altogether.

Remember folks, long-term view > short-term losses. ;-)

Nvidia ranked #11 on HackerNoon's Tech Company Rankings this week.

In Other News.. 📰

- Michael Saylor's MicroStrategy Makes Mammoth BTC Purchase, Adding 55,500 Tokens for $5.4B — via

CoinDesk - UK seeks collaboration for security research lab to counter Russia and ‘new AI arms race’ — via

TechCrunch - China’s richest man blasts tech giants and government inaction in rare rebuke — via

CNN - Google's US antitrust trial over online ad empire draws to a close — via

Reuters - AI's scientific path to trust — via

Axios - How tech bros bought ‘America’s most pro-crypto Congress ever’ — via

CNBC

And that's a wrap! Don't forget to share this newsletter with your family and friends! See y'all next week. PEACE! ☮️

—

*All rankings are current as of Monday. To see how the rankings have changed, please visit HackerNoon's

Tech, What the Heck!? is a once-weekly newsletter written by HackerNoon editors that combine HackerNoon's proprietary data with news-worthy tech stories from around the internet. Humorous and insightful, the newsletter recaps trending events that are shaping the world of tech. Subscribe