The Santa Clara, Calif.-based chip maker, popular for its GeForce line of gaming video cards, saw a meteoric rise in its stock price this past couple of weeks following its earnings release. The catalyst? Artificial intelligence.

The public release and subsequent success of ChatGPT may have turned both OpenAI and

It all began with the

Team Green said it expected to generate $11 billion in sales during the second quarter of the year, a whopping 50% above Wall Street estimates of $7.15 billion. "The computer industry is going through two simultaneous transitions — accelerated computing and generative AI," NVIDIA founder and CEO Jensen Huang said at the time of the earnings release. "We are significantly increasing our supply to meet surging demand for them."

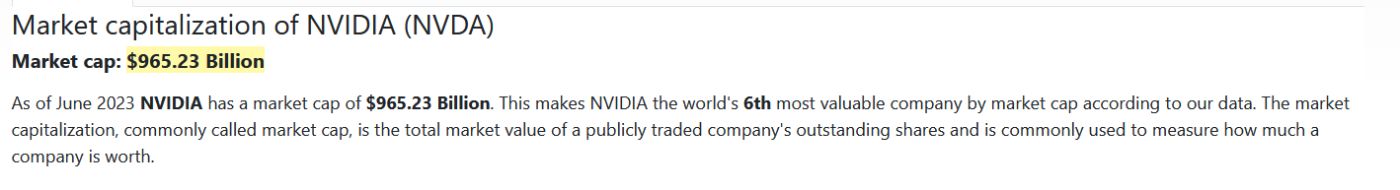

Immediately, Nvidia stocks began rising and the company's shares briefly crossed the $400 apiece mark, giving it a valuation of over $1 trillion — only the fifth U.S. company to have ever done so. While the company's shares have dropped below the $400 apiece mark, they're still a lot more valuable than just two weeks ago, safely adding

Nvidia has had a string of success with its graphic cards, though not necessarily for the reasons everyone assumes. Graphic cards have traditionally been a mainstay of PC gaming, but with the craze surrounding cryptocurrency, particularly during the COVID-19 pandemic, the computational prowess of the company's graphic cards became essential for miners looking in to cashing in on the crypto boom, making them "

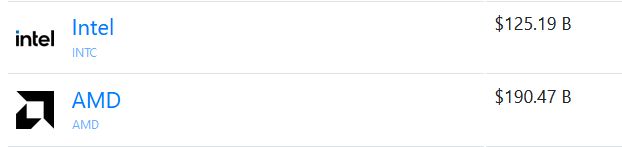

The company was already the most valuable chip manufacturer in the world, even before the craze surrounding AI, valued at far higher than competitors Intel and AMD, who, although very, very successful by their own account, are nowhere near as valuable as Nvidia. Don't believe us? Here's what they're valued at today.

Not even $200 billion. It's hard not to feel bad for either companies. (

For comparison:

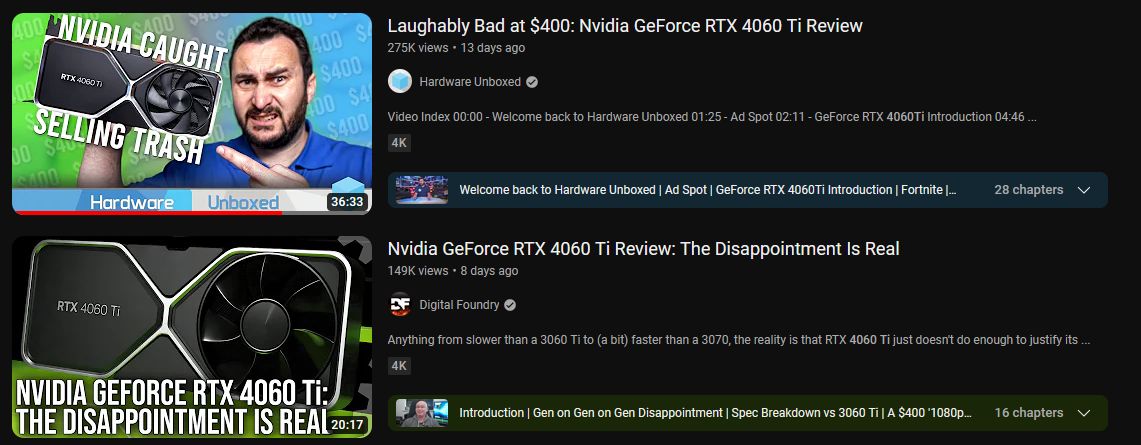

Nvidia's success is good news for literally everyone, except gamers. The company's stock kept rising despite a

But CEO Huang doesn't seem too bothered by the lack of sales for gaming graphic cards, which were down 38% year over year to $2.24 billion in the first quarter of 2023. In fact, at the recent Computex 2023 event in Taiwan, Huang spent

Whether Nvidia's stock is over inflated, only time will tell. For now, the company is doing well for itself, with expectations that it will ultimately enter and remain in the trillionaire club.

Neither of Nvidia, Intel, or AMD trended on HackerNoon's Tech Company Rankings this week, but Microsoft, the backer of ChatGPT creator OpenAI, was on the #4 spot.

👋 You’re reading part 1 of HackerNoon's Tech Company News Brief, a weekly collection of tech goodness that combines HackerNoon's proprietary data with internet trends to determine which companies are rising and falling in the public consciousness. Part 2 goes live tomorrow. Hate waiting? No problemo! Just subscribe here to receive the complete newsletter a day early in your inbox.

In Other News.. 📰

- The world's largest cryptocurrency exchange is getting the FTX treatment. U.S. authorities filed a lawsuit against

Binance and its CEO Changpeng Zhao for allegedly operating a "web of deception ." Binance was trending #17 on HackerNoon’s Tech Company Rankings. - Spotify

laid off 200 people from its podcast unit. - Japan has asked ChatGPT-creator OpenAI to

not collect sensitive data without people's permission in training its machine learning algorithms. - Twitter's head of brand safety and ad quality, A.J. Brown, has decided to

leave the company , Reuters reported. Twitter was trending #57 on HackerNoon’s Tech Company Rankings. - YouTube will

no longer remove videos peddling false information about previous U.S. elections. The company ranked #21 on HackerNoon’s Tech Company Rankings.

And that's a wrap! Don't forget to share this newsletter with your family and friends!

See y'all next week. PEACE! ☮️

— Sheharyar Khan, Editor, Business Tech @ HackerNoon