Having signed the U.S. Inflation Reduction Act, the current president of the United States has started a process that will help reign in ballooning everyday prices for the average American and transition the country away from dirty fuels. Never mind the fact that experts and rating agencies say it will be years before the masses see any benefit and that you can't even use the much-touted electric vehicle credits to purchase a Tesla. At least not yet.

But what do the tech giants think about all of this and how does inflation impact them and their businesses? Let's find out in Tech Company Brief Issue #12.

Those Pesky Taxes!

Silence can be deafening, and as this report from SDxCentral points out, the tech giants are yet to publicly comment on the bill. Yet, that hasn't stopped them from expressing their disliking through other means.

Instead of opposing the Inflation Reduction Act head-on, the companies have let their displeasure known through The Business Roundtable, a trade group that counts the CEOs of Google, Microsoft, Apple, and Amazon as its members. Weeks before the bill signing, The Business Roundtable said it strongly opposed the legislation because it increases corporate taxes. The U.S. Chamber of Commerce, which has various members from the tech sector, also made a similar comment.

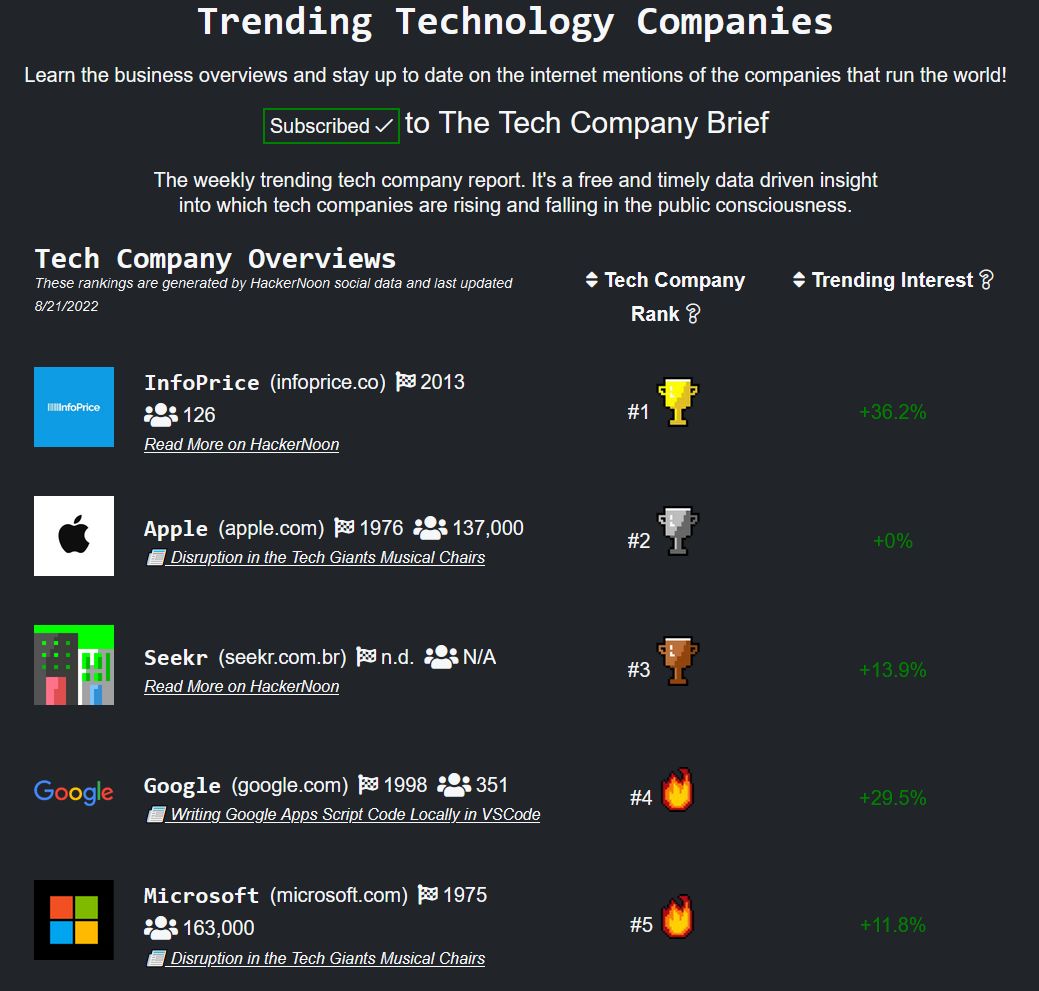

It's really not clear whether the issue is taxes or something else, and the tech giants' silence really isn't helping. Nonetheless, with all that chatter of inflation and corporate monoliths, the companies were back in the public consciousness and HackerNoon was able to plot their rankings using its unique data.

Apple 🍎

The Silicon Valley darling seems to have an easier time with inflation than most would expect. Analysts believe the tech giant is immune to broader economic hurdles given iPhone's loyal and relatively affluent customer base. The company's stock price has also started reversing its losses from the start of the year as investors rally back towards tech shares.

Though the tech giant insists that it's operating in a "challenging" environment, its earnings speak for themselves. In the most recent quarter, the company reported better-than-expected sales and profit of $83.0 billion and $1.20 per share, respectively.

Apple ranked #2 in this week's tech rankings.

Google 🔍

The OG and stalwart of web 2.0

First, it nixed the idea of raising pay companywide. Then it said "loljkjk". And now it's teaching everyone else how to deal with it. That, in a nutshell, is how Google is going about addressing the topic of inflation.

Low-key behavior results in a low-key rating. Google ranked #4 in this week's tech rankings.

Microsoft

Things at Microsoft have been a little different, albeit also contradictory. Dare we say, almost Gemini-esque?

The Redmond firm wanted to retain its talent so it did what any sensible company would do: it raised pay to help employees beat inflation. But then just a few weeks later, it started cutting jobs as part of a 'realignment'. Ouch!

Not to mention, last quarter Microsoft reported the slowest growth in revenue since 2020 with profits failing to meet analyst expectations as the company's key businesses reeled from inflationary pressure. Yet, the future of the company's thriving cloud business remains bright with the tech giant forecasting that its annual revenues would grow by double digits.

And as GeekWire reports, the passing of the U.S. Inflation Reduction Act also means the company is closer to achieving its goal of cutting carbon emissions.

Microsoft ranked #5 in this week's tech rankings.

Amazon 📦

Of course, no talk of inflation is complete without a mention of our eCommerce overlord, Amazon.

Amazon's pay policies have always been a tad on the lower end and debate over its low wages returned to the spotlight after workers walked out of their jobs in California and the UK demanding better pay. While the company has raised the prices of its Prime membership in both the U.S. and the EU to meet its operating costs, it's not really clear whether those operating costs include paying its workers more money.

Inflation is particularly bad news for Amazon because it hurts the people using its service: the shoppers. And when shoppers spend less, the company makes less, prompting an increase in the prices of existing services to make up for the shortfall. It's a vicious cycle.

Add that to the fact that the company is most definitely going to pay higher taxes in light of the Inflation Reduction Act and things don't look too good. The only silver lining the bill provides is that it could make it easier for Amazon to achieve its goal of cutting carbon emissions.

Amazon ranked #7 in this week's tech rankings.

And that's a wrap! Thanks for reading Tech Company Brief Issue #12! If you'd like to see which tech companies are rising and falling in the public consciousness, feel free to head down here. See y'all next week.

PEACE! ☮️