You don't need me to tell you how impressive that is, especially considering that it was only in March that Nvidia hit the $2 trillion market valuation for the first time. What's impressive still is that some analysts believe the company is headed for a

Which begs the question, should you invest in Nvidia? Well, dear reader, here are some of the arguments for and against investing in the company.

Now, before you go and start pouring in all your life savings into buying Nvidia stocks, there are a few things you may want to consider. First, don't expect to make massive gains if you decide to buy the stock now. According to The Motley Fool, the upside is

Compare that to the fact that people who bought the stock at the start of 2023 saw a meteoric rise in the value of their shares: a whopping 8,280%! In fact, if you had invested in Nvidia's stock at the start of this year, you would have already seen a gain of 174%!

By that comparison, 50% probably feels like peanuts. Like Axios

Still, proponents of investing in Nvidia point to the company's

The generative AI boom isn't the only thing that is helping Nvidia, though. Some other factors that will drive the company's business is a subsiding in inflation which is expected to open up demand for graphic cards, meaning the company will likely see a bump in GPU sales come update cycle.

BUT, and there's always a but, Nvidia's stock is susceptible to volatility. We've already seen some of this play out this past week, when, after briefly becoming the

Some publications, like London's Financial Times, are also

"Nvidia will decelerate," Barry Bannister, chief equity strategist at Stifel, was quoted as saying by the FT.

The recent Nvidia selloff, which saw the company's stock slump 13%, made short sellers

Regardless of whether you think the stock will go up or down, there is enough research out there that supports either thesis. Just don't go to Reddit for advice :-)

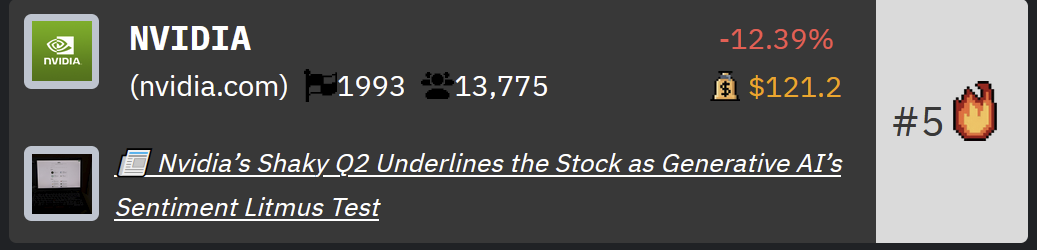

Nvidia ranked #5 on HackerNoon's

Sponsored Content

Discover Institutional-Grade Wealth Management with Heron Finance

Once, private credit investments were exclusive to the ultra-wealthy and institutional investors. That’s why Heron Finance built a seamless platform for any accredited U.S. investors to maximize their returns.

Heron Finance’s investment analysts line up highly collateralized deals for consistent returns. Heron Finance lowers volatility and manages risk based on how they select deals:

- Maintaining strict criteria for filtering prospective deals, ensuring that underlying borrowers stay profitable or hold assets to secure payments

- Vetting every deal with a rigorous analytical process designed to reduce risk Partnering with other lenders to find the most creditworthy deals

- Continuously monitoring all investments with regular borrower reporting

Once you’ve made an investment, Heron Finance's robo-advisor also handles automated portfolio rebalancing, taking the stress out of managing your investments. Whether you're a seasoned investor or new to private credit, Heron Finance gives you the tools you need.

Don't wait to improve your investment strategy, try Heron Finance and start maximizing your return potential.

Risk disclosures: http://heronfinance.com/

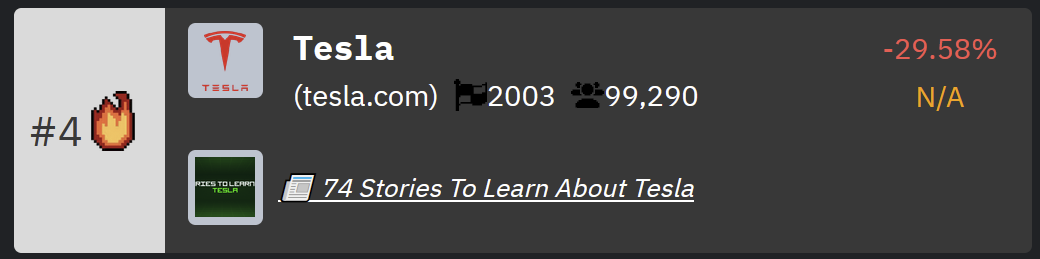

Tesla Sues Supplier for Stealing Trade Secrets

Matthews became one of Tesla's suppliers in 2019, and the automaker said it shared confidential designs of industrial machinery necessary for the manufacturing process of its batteries after it entered a nondisclosure agreement with the electric vehicle producer.

"Matthews betrayed that trust," Tesla is alleging in its lawsuit.

Tesla went on to accuse Matthews of using its designs and passing them off as its own and building and selling equipment for dry-electrode battery manufacturing that are based on its "confidential trade secrets."

On the other hand, Matthews is claiming that Tesla is

It was precisely because of Matthews' work that Tesla approached the company in the first place and narrowed it down as a supplier.

Both sides plan to pursue this in court, so let's see how it plays out.

Tesla ranked #4 on HackerNoon's

In Other News.. 📰

- Renewed Bullishness Expected After Bitcoin, Ether's $10B Options Expiry on Friday — via

CoinDesk - AThis smiling robot face made of living skin is absolute nightmare fuel — via

TechCrunch - Microsoft faces mega fine after EU takes issue with bundling of Teams and Office — via

CNN - AI dataset licensing companies form trade group — via

Reuters - Book authors get a startup to help them deal with AI companies — via

Axios - U.S. chip curbs in Middle East just 'business as usual,' Ooredoo CEO says after Nvidia deal — via

CNBC

And that's a wrap! Don't forget to share this newsletter with your family and friends! See y'all next week. PEACE! ☮️

—

*All rankings are current as of Monday. To see how the rankings have changed, please visit HackerNoon's

Tech, What the Heck!? is a once-weekly newsletter written by HackerNoon editors that combine HackerNoon's proprietary data with news-worthy tech stories from around the internet. Humorous and insightful, the newsletter recaps trending events that are shaping the world of tech. Subscribe