The US elections are over and Donald Trump has been elected to the highest public office in the US. Political pundits will spend the next few weeks dissecting what went wrong and what went right, but I want to take a moment to look at some of the Ts.

T for Trump. T for

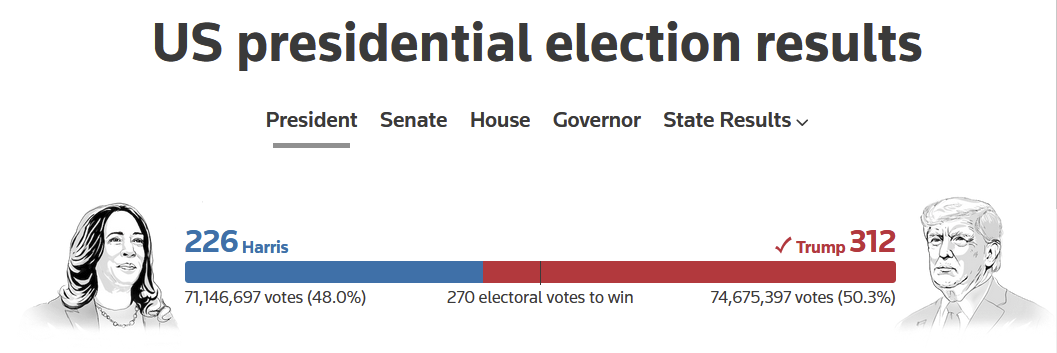

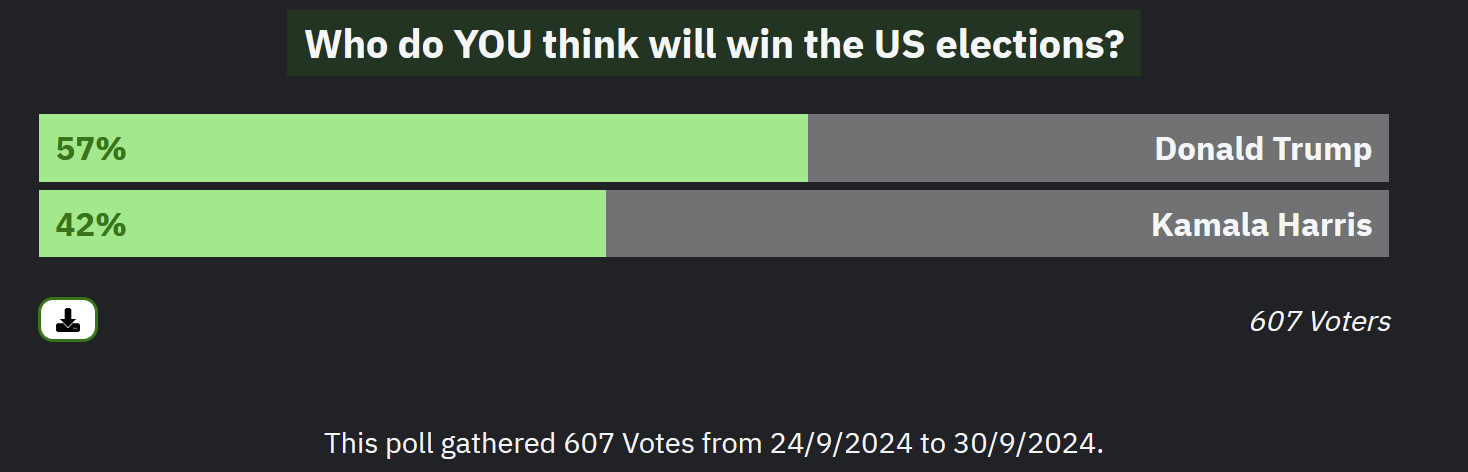

Most polls showed a close race, but betting markets overwhelmingly predicted that Trump would win. And win he did. Not only did Trump win the popular vote, he won significantly more electoral votes than his competitor, Kamala Harris. Per

I personally thought Harris had a chance when she announced her candidacy, but felt the scales tipping in Trump's favor as the elections neared. Betting markets had

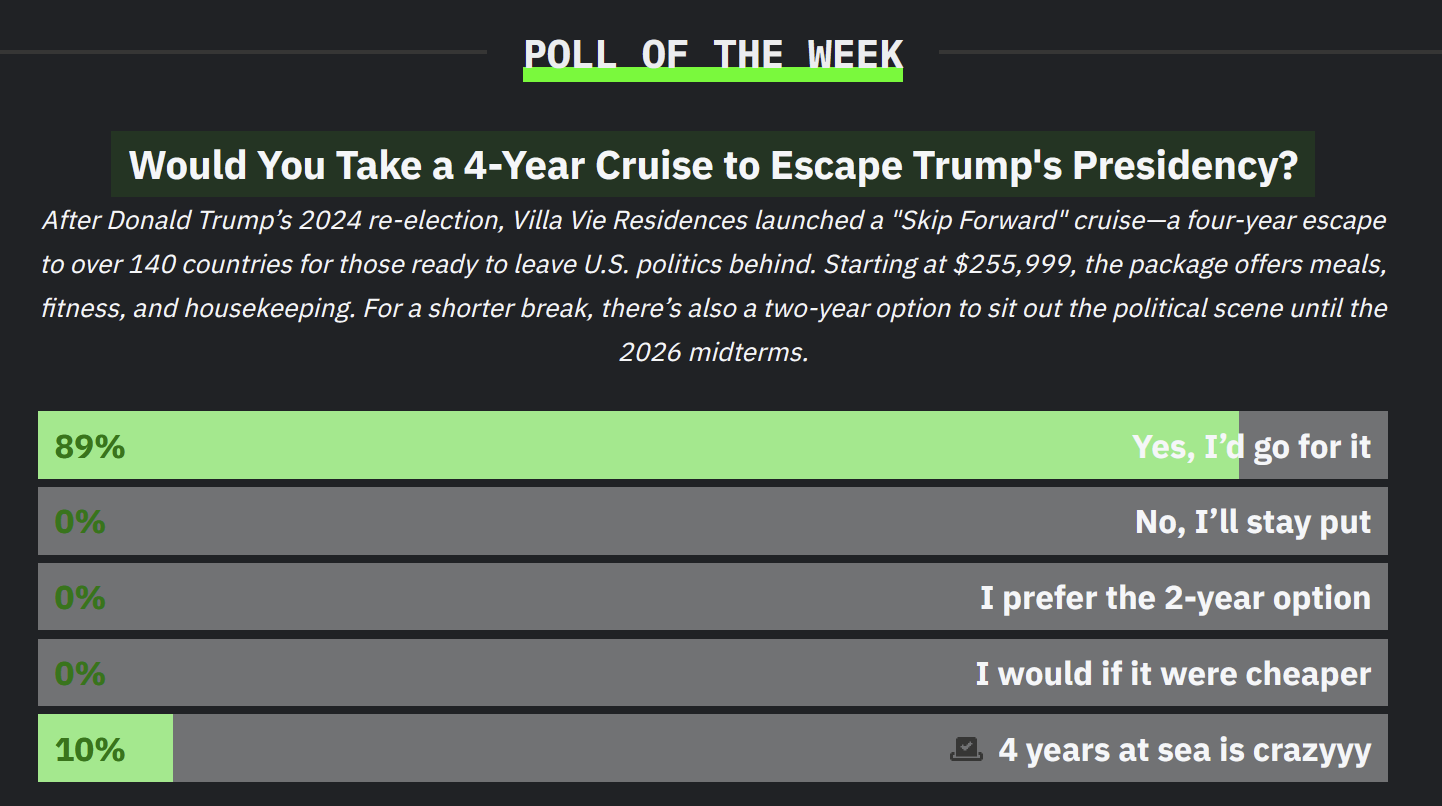

Although, HackerNoon readers would now rather escape Trump's presidency for the next four years, a sentiment shared by despondent Americans who are also

But back to the Ts.

Trump's win has seem to done some wonderful things for the president-elect and those closest to him, starting with Trump's own social media company Trump Media & Technology Group. The election win blasted the company's stock price

John Oliver has a great segment on the disconnect between Trump Media & Technology Group's valuation and underlying fundamentals on Last Week Tonight, which I highly recommend you

Which brings us to the second T, and by far the best return on investment on donating to a presidential candidate's campaign. Elon Musk and his electric car maker Tesla.

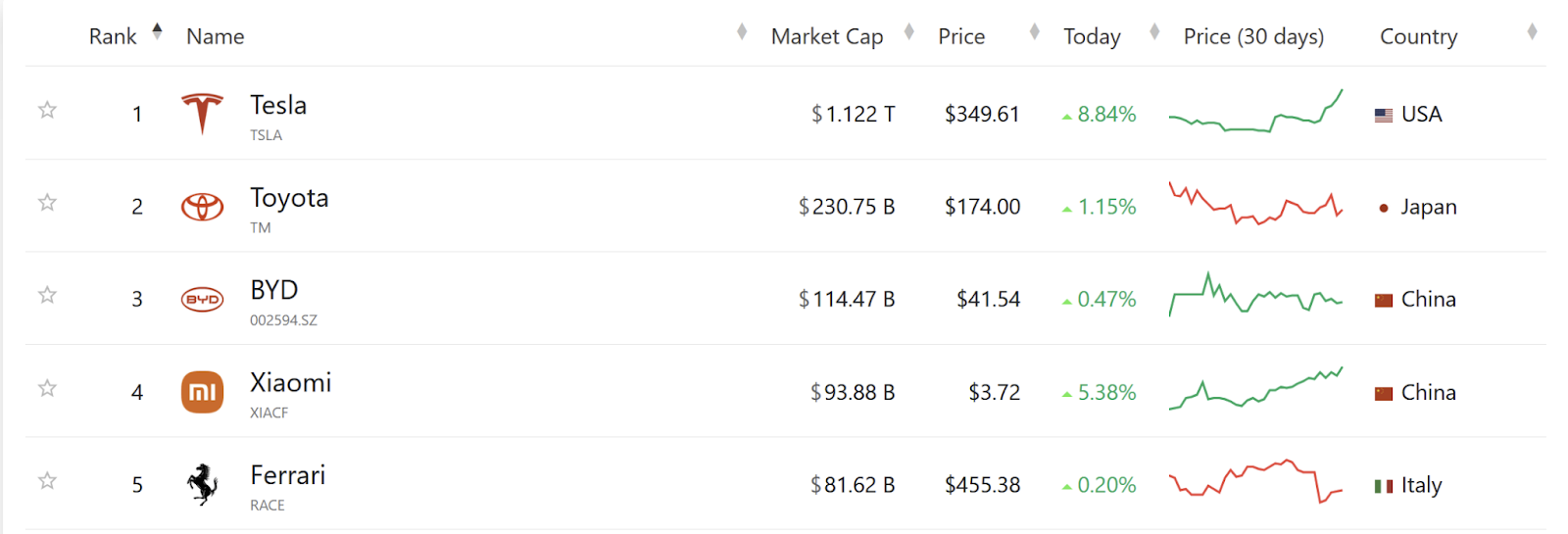

Musk's close relationship to Trump did not go unnoticed on Wall Street, and Tesla's stock price soared as soon as it became clear Trump was going to win the White House. Investors are betting that Musk's close ties with Trump will greatly benefit his companies, so much so that Tesla

Not only has the ascent propelled Tesla's valuation to over $1 trillion (not for the first time, however), it has also given it an oversized lead against the next automaker in line, Toyota, which is valued roughly five times less than the electric vehicle maker.

Before the elections, I

Join a global network of 45,000+ published devs, builders, founders, makers, VCs, hodlrs, and hackers. Start submitting your tech stories and tutorials to get published FREE on HackerNoon — no pop-ups, no paywalls.

Which brings us to the third T: Technology. Wall Street has been

If I had to harbor a guess as to why that may be, it could be because Trump could roll back regulations and rules for businesses, in contrast to the hard line the Biden administration took on Big Tech.

And then, the B: Bitcoin.

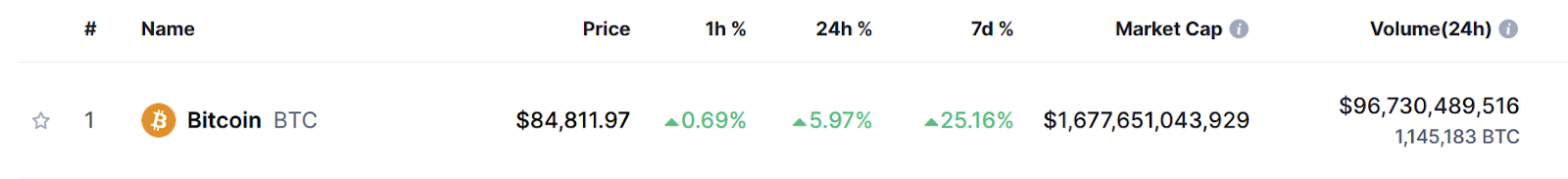

Crypto investors must be going nuts as the world's most popular cryptocurrency inches closer and closer to the $100k mark. Trump's win propelled bitcoin to an an all time high this past week, but at the time of writing, it was on track to hit an even

Crypto investors are perhaps excited about the idea of a crypto ally entering the White House, and when taken with Trump's aversion to SEC Chairman Gary Gensler, are expecting mainstream adoption of bitcoin. Whether that will happen or not is anyone's guess, but that's not stopping investors from jumping in on the gains while they can.

Now, before you go on celebrating Trump's win and making some investments of your own, I do want to point out that the gains are tied specifically to Trump and may be divorced from reality.

If history is any indicator, the Trump euphoria will die down and the hype surrounding these assets will fade. All that will be left will be a scrutiny of Trump and his time in the White House, and if Trump can bring stocks up, he can bring them down.

The last thing you want is to be caught in a course correction ;-)

Anyway, that was your brief recap of last week. Tesla ranked #15 on HackerNoon's Tech Company Rankings.

In Other News.. 📰

- MicroStrategy Buys Another 27,200 BTC for $2B; Bitcoin Profits Sit at $11B — via

CoinDesk - Intuitive Machines CEO: ‘We now have the platform for a lunar economy’ — via

TechCrunch - Google and Meta are blocking political ads to combat misinformation. Some experts say it’s too late — via

CNN - OpenAI and others seek new path to smarter AI as current methods hit limitations — via

Reuters - Anthropic, Palantir, Amazon team up on defense AI — via

Axios - FTX sues crypto exchange Binance and its former CEO Zhao for $1.8 billion — via

CNBC

And that's a wrap! Don't forget to share this newsletter with your family and friends! See y'all next week. PEACE! ☮️

—

*All rankings are current as of Monday. To see how the rankings have changed, please visit HackerNoon's

Tech, What the Heck!? is a once-weekly newsletter written by HackerNoon editors that combine HackerNoon's proprietary data with news-worthy tech stories from around the internet. Humorous and insightful, the newsletter recaps trending events that are shaping the world of tech. Subscribe